As you prepare for your first payrolls of 2014, you should be aware that state minimum hourly wage changes took effect on January 1, 2014 unless otherwise noted below. If you are a multi-state employer with operations outside of Massachusetts, it is important to know that many states provide annual increases to the State Minimum Wage based on the U.S. Consumer Price Index and inflation.

Current Federal Minimum Wage Rate

Under the Fair Labor Standards Act (FLSA), the current federal minimum wage is $7.25 per hour. However, because the FLSA does not supersede any state or local laws that are more favorable to employees, if a state has a minimum wage that is higher than the federal minimum, employers subject to the state minimum wage law are obligated to pay the higher rate to employees working in that state.

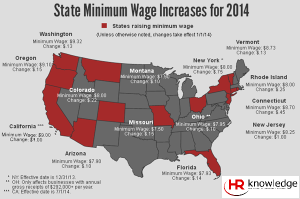

Minimum Wage Increased by State

Click here for a map that shows the states that have increased their minimum wages, including the new rate and amount of the increase.

- Arizona, to $7.90 for non-tipped employees and $4.90 for tipped employees

- California, to $9.00 for all employees (effective July 1, 2014)

- Connecticut, to $8.70 for non-tipped employees, $5.69 for service employees (waiters/waitresses at hotels and restaurants) and $7.34 for bartenders

- Florida, to $7.93 for non-tipped employees and $4.91 for tipped employees

- Missouri, to $7.50 for non-tipped employees and $3.75 for tipped employees

- Montana, to $7.90 for non-tipped and tipped employees

- New Jersey, to $8.25; employers subject to the Fair Labor Standards Act to $2.13 for tipped employees

- New York, to $8.00 (effective December 31, 2013)

- Ohio, to $7.95 for non-tipped employees and $3.98 for tipped employees (will apply to employers who gross more than $292,000 per year beginning in 2014)

- Oregon, to $9.10 for non-tipped and tipped employees

- Rhode Island, to $8.00 for non-tipped employees and $2.89 (no change) for tipped employees

- Vermont, to $8.73 for non-tipped employees and $4.23 for tipped employees

- Washington, to $9.32 for non-tipped and tipped employees

Localities – Certain localities also have implemented minimum wage legislation. For example, in San Francisco, the minimum wage increased on Jan. 1 from $10.55 to $10.74 an hour, and San Jose, California, increased its minimum wage from $10 to $10.15 an hour. (California law does not allow employers to take a tip credit against minimum wage for tipped employees.) In addition, the Albuquerque, New Mexico minimum wage increased from $8.50 to $8.60 effective Jan. 1. However, the minimum wage in Albuquerque is $7.60 if an employer provides healthcare and/or childcare benefits to the employee during any pay period and the employer pays an amount for these benefits equal to or in excess of an annualized cost of $2,500. Minimum wage for tipped employees increased from $3.83 to $5.16.

Additional Resources: